Identity Verification for Online Casinos – the 2021 Guide

22 Jan 2020

Introduction

The global online gambling industry was worth in excess of $45 billion in 2017 and is predicted to rise to $94.4 billion by 2024. With such a stark rise in use and increasingly large sums of money moving through these entities, online gambling and gaming institutions are facing the same scrutiny to which other banks and other financial entities are subject. Prime targets for identity fraud, money laundering, and international financial crime, regulatory compliance is intensifying to ensure that online casinos and gambling institutions are taking serious measures to prevent such illicit activity.

One of the main compulsory onboarding processes involved in anti-money laundering legislation is ‘Know Your Customer’. As an identity verification measure, online gambling institutions must identify and verify customers to flag potentially risky users and monitor for suspicious activity.

However, as the demand for online gambling services increases, so does the stringency of regulatory compliance. Not only does this mean hiring a large compliance team to deal with the backlog, but online casinos are also now subject to higher costs and wait times for identity verification procedures. In this sense, manual KYC processing for casinos is a little outdated, offering a clunky solution that wastes time, squanders budgets, and is littered with errors.

In today’s technological era, it’s time for a more streamlined solution to identity verification or online casinos. Using state-of-the-art technology, GetID offers a multi-tiered architecture to ensure accurate identity verification for a fraction of the price, without the wait times. Our omnichannel platform enables online casinos and gambling platforms to verify customers without hassle. This next-generation solution eliminates the need for huge compliance teams, multiple third-party verifiers, and unnecessary delays and costs. Instead, online gambling providers and casino users can now enjoy almost instantaneous identity verification without the exorbitant outlay, while keeping up to date with increasing regulatory compliance now and into the future.

Keen to know more? This guide to ID verification for casinos provides a comprehensive breakdown of what casinos need to know to stay compliant, and how GetID offers a first-rate solution for smoother onboarding.

What is KYC and ID Verification?

KYC is an acronym for ‘Know Your Customer’. Deployed to verify the identity of users, KYC processes are an integral part of Anti-Money Laundering (AML) compliance. Sometimes referred to as ‘Enhanced Due Diligence’ when relating to online gambling establishments, KYC is a mandatory account verification process to help prevent financial crime from the outset.

In short, KYC processes are used to verify that a customer is who they claim to be. For banks and financial institutions, this helps to prevent fraud, financial crimes, and money laundering. For online gambling entities, KYC is also used during the onboarding process to verify customers’ identities, but it extends beyond simply financial crimes.

Identifying customers using Personal Identifiable Information (PII) and official identity documents, KYC helps to stem the flow of illicit funds being ‘washed’ through online gambling establishments. Moreover, KYC procedures also help to weed out underage gamblers, users attempting to play with multiple accounts, and gambling addicts who have added themselves to self-exclusion lists. Not only does this protect casinos against being used for criminal purposes, but it also ensures online gambling establishments aren’t tricked into losing funds by inappropriate users.

The reason that KYC procedures are especially important for online gambling entities is that money laundering and terrorist funding are often undertaken on an international basis. As online casinos often enable gamblers from various international jurisdictions, strict safeguards are needed to prevent illicit activity from leaking across borders.

What Does the Law Say?

As noted above, one of the most difficult aspects of regulatory compliance for online casinos is that customers often sign up from international jurisdictions. While an online casino may be registered to the US, users may hail from the EU or the UK, where regulatory compliance is far more rigid than the US.

What many online casino proprietors don’t realize, is that even if an internet gambling platform is registered to a more jurisdiction with more lenient regulations, these entities are still subject to the regulations imposed by each user’s nation. For example, Costa Rica, a hotspot for online gambling companies, has very loose gambling regulations. Despite this, if an online casino based in Costa Rica serves UK clients, it is subject to the rigorous AML and KYC procedures imposed on UK online casinos.

In this sense, online gambling establishments need to align themselves with the AML and KYC regulations imposed by stricter jurisdictions worldwide, such as the USA, UK, and the EU.

USA

In the USA, online gambling establishments that have gross revenue of over $1 million are classed as non-bank financial institutions (NBFI). This means they must adhere to similar regulations as banks to help prevent fraud, financial crimes, and money laundering.

The Financial Crimes Enforcement Network (FinCEN) is responsible for monitoring the compliance of AML regulations under the Bank Secrecy Act (BSA). The BSE requires that financial institutions must help the government identify and prevent money laundering by identifying, flagging, and reporting certain suspicious activity and transactions. FinCEN has assigned this responsibility to the Internal Revenue Service (IRS) to ensure compliance measures are being met.

For relevant online casinos, AML measures include filing suspicious activity reports (SARs) for unusual transactions of over $5000, as well as reporting currency transactions of over $10,000. There are also extremely tight requirements for recordkeeping and receipt storage, as well as credit extensions over $10,000.

While all of these AML measures are a must, US online casinos are first required to accurately identify and verify customers using KYC processes. Failure to do so results in unbelievable fines. In fact, the American Gaming Association (AMA) recently updated their policies. According to these new regulations, US users can not open an account without providing basic PII details: full legal name, address, and social security number. More importantly, however, no real money transactions can be undertaken without submitting official government ID and proof of a permanent address.

The poignant point here is that AMA’s rules apply to the patron, not the casino as such. In this sense, a US citizen using an online casino in a different jurisdiction must still provide this information. If online gambling platforms don’t have measures in place for this, they are in danger of non-compliance.

United Kingdom

UK AML regulations are extremely strict, based on the Proceeds of Crime Act. However, the UK’s insistence on KYC procedures for online gambling entities is not solely focused on anti-money laundering. Instead, the UK has deployed stringent rules on KYC processes for three main reasons. Firstly, by verifying a user’s identity, KYC procedures help to prevent underage gambling.

Secondly, to stem the issue with gambling addiction, KYC procedures should identify whether the user has self-excluded themselves from gambling. Voluntary Self-Exclusion programs enable gambling addicts to add themselves to watchlists to prevent casinos from allowing them to gamble. KYC processes should run users against these lists to identify addicts and stop them from opening accounts.

Lastly, identity verification helps to identify potentially high-risk candidates who may hold political positions of power or be subject to financial sanctions. This helps to protect against money laundering, terrorist funding, and other financial crime.

Interestingly, the UK’s strict verification procedures, known as ‘Threshold Verification’, meaning that all users must complete KYC upon opening an account. Where other jurisdictions may not require casino KYC checks until deposit or withdrawal, the UK insists this process is completed immediately upon signup.

European Union

The key pieces of legislation that guides AML and KYC compliance for EU online casino users are the EU 4th Money Laundering Directive and the Prevention of Money Laundering Act (Malta).

These two directives outline pretty similar AML policies to the USA and UK but are a little more lenient on KYC. According to EU law, KYC procedures aren’t triggered until players deposit over 2000 EUR into an online casino account.

Why is ID Verification So Important for Online Casinos?

Casinos deal in financial transactions, often on a very large scale. Online gambling platforms and casinos can turn over millions of dollars a day, making them a prime target for money laundering and financial crimes. Not only that, the lack of face-to-face interaction on internet gambling platforms makes it easier for fraudulent users to play on these sites without detection.

KYC and identity verification processes are designed to help reduce the risks of illicit activity by identifying customers and verifying that this identity is correct. In doing this, suspicious characters and potentially high-risk users can be flagged and monitored, or banned.

There are three main reasons that online gambling establishments should be sitting up and taking note. Without effective KYC policies, online casinos and gambling platforms are at risk of money laundering, various types of fraud, and sky-high non-compliance fines.

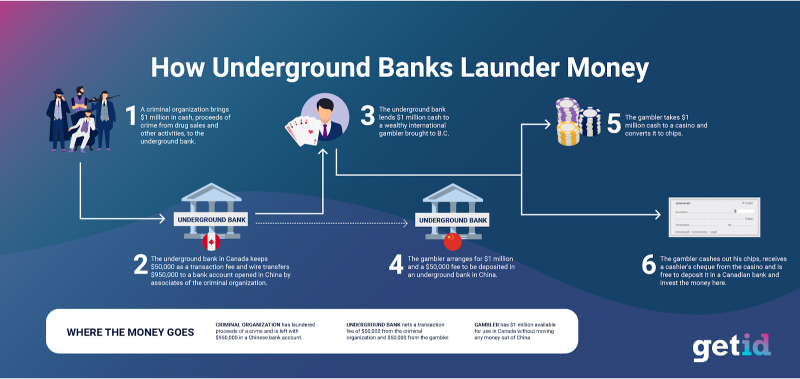

Anti-Money Laundering

Money laundering can have extreme impacts on economies and jurisdictions. The influx of large sums of illicit money can destabilize economies and drive the value of national currencies downward. In this sense, not only is money laundering being used to fund the expansion of criminal entities and terrorist cells, but it also affects a nation’s markets across the board. Currently, it’s predicted that 2-5% of global GDP is laundered money, equating to between $800 billion and $2 trillion. Unfathomable sums of this nature have the power to shake the bedrock of the US economy.

While money laundering may seem to be a primary concern for banks and financial entities, studies show that casinos are ripe for money laundering. In 2014, Finnish gambling operators submitted over 9000 money laundering reports. In comparison, during the same timeframe, Finnish banks turned in just 1125 money laundering reports. Even five-year-old figures show the gravity of the issue and the need for better regulations and processes to handle this issue. What’s more, online access and pseudonymity (especially thanks to the introduction of cryptocurrencies) are increasing the problem.

Studies are showing that criminal groups, known as dot.cons work together to ‘wash’ funds by deliberately losing games and claiming ‘clean’ prize money. A great example of this was The Corozzo Network, operating from 2005 to 2008. The network of 26 members ran illegal gambling and loan-sharking services through four online gambling sites, laundering more than $10 million.

More recently, CG Technology (trading as Cantor Gaming) was fined $22.5 million by various regulatory bodies in 2016 for poor AML provisions. The gambling company’s lack of AML procedures enabled 26 individuals, known as the ‘Jersey Boys’, to launder large sums of money through the platform with bad bets.

Further still, as technology advances, the schemes become more complex. Thanks to the introduction of virtual credit cards, prepaid mobile credit, and alternative payment gateways like PayPal, micro-laundering is now easier than ever and far less detectable.

By introducing strict KYC checks, casinos mitigate the risk of becoming vehicles for money laundering as high-risk individuals are flagged from the outset.

Fraud Prevention

Fraud comes in many different shapes and sizes when it comes to online gambling. As there is little to no face-to-face interaction, catching fraudulent users can be a trickier task. Traditionally, patrons of bricks-and-mortar casinos would have to exchange hard cash for chips in the establishment. With internet gambling, users have a wealth of opportunities to deposit illicit funds or fraudulently impersonate others.

Identity theft is a big problem in online gambling. Users can fraudulently obtain credit card details and use these payment methods to enter games using someone else’s funds. Equally, users can submit fraudulent documents, playing under other people’s identity to avoid the repercussions from terrible losses.

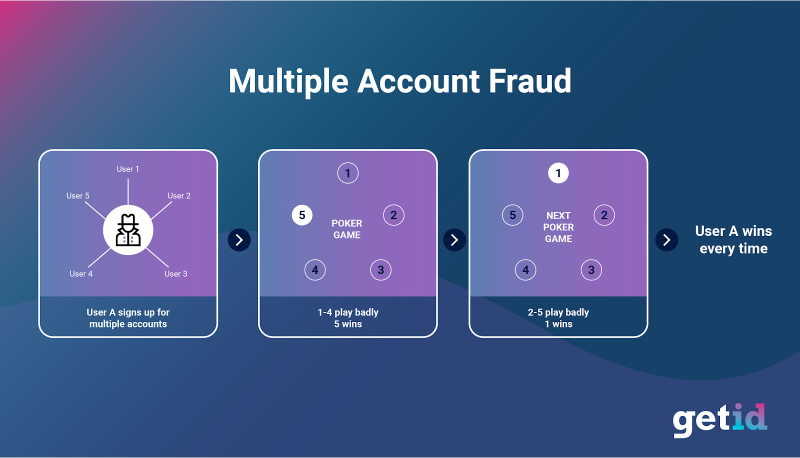

Perhaps one of the most damaging forms of fraud for online casinos is multiple account fraud, where users create fake accounts to throw games. Imagine that a user creates 5 fake accounts and enters all five accounts into a poker game. If four of the accounts deliberately lose, the fifth account will win. Online casinos can lose large sums of money from this type of fraud.

What’s more, fraud doesn’t always come from the usual suspects. The number of child gamblers is also terrifying. Statistics show that 450,000 children between the ages of 11 and 16 illegally gamble in the UK regularly. Often using their parents’ accounts of ID documents, children are rapidly becoming addicted to casino games. In fact, figures as far back as 2008 show that around 47% of users claiming to be in their 40s were actually teenagers who had stolen their parents’ account details.

Fraud of this kind can cost gambling establishments millions of dollars in lost revenue. By implementing stringent identity verification procedures from the outset, online casinos are far more likely to identify suspicious users and keep them at bay, as they won’t be able to validate and verify their details.

Non-Compliance Fines

Aside from the devastating effects of money laundering and fraud, online casinos need to recognize the importance of sufficient identity verification procedures in staying up to date with increasing regulatory compliance. In order to stem the problems that are rapidly arising from online gambling, regulatory authorities are cracking down hard, often imposing unimaginable fines on gambling establishments that don’t adhere to legislation.

Last year, in the UK alone, regulatory authorities fined gambling companies $25.6 million for failing to comply with stipulations on AML policies and self-exclusion. Among those penalties was a staggering $9.2 million imposed on the online casino, Daub Alderney, for insufficient measures to prevent problem gamblers playing and for poor AML policies. Paddy Power Betfair (now renamed Flutter Entertainment) was fined nearly $2.9 million for shoddy AML practices, while Casumo was ordered to pay $7.6 million.

In the US, online gambling website, DraftKings, was fined last year for allowing 54 bettors to gamble despite being on self-exclusion lists. Of those 54, 13 gamblers lost a total of $28,800, triggering the New Jersey Division of Gaming Enforcement to dole out a notable penalty for poor identity checks.

Despite these harsh financial penalties, studies still show that over 14% of online gambling casinos still have no measures for monitoring self-exclusion, while ‘No Verification’ casinos are still rife.

What Are Online Casino KYC Procedures?

Know Your Customer procedures are a mandatory part of anti-money laundering legislation. Guidance from regulatory bodies varies from jurisdiction to jurisdiction, but the overall message is the same: identify customers and accurately verify that this information is correct, followed by ongoing monitoring of transactions and behavior.

FinCEN’s most recent guidance document outlines the basic procedures that online casinos should have in place to ensure ongoing compliance with BSE. This includes independent compliance testing to measure the risks of money laundering for each product offered, along with procedures to identify and verify all customers using official documentation and PII. On top of this, however, online casinos must dedicate time and money to training staff on compliance, assigning a specific individual or individuals to ensure day-to-day compliance and the maintenance of records.

To compound this further, the AMA has released its own documents for best practices on AML compliance and KYC procedures. This guide stresses the importance of stringent risk assessments, preventative steps, and customer due diligence, along with in-depth employee training. While this guide calls for consistent monitoring of suspicious transactions, it strongly advises detailed KYC procedures to securely verify user identity with documentation and personal details using third-party independent verifiers.

Equally, EU regulations state that online gambling entities must focus on “identifying the customer and verifying the customer’s identity on the basis of documents, data or information obtained from a reliable and independent source”, while UK regulatory bodies state that online casinos must put serious effort into “ensuring that the customer’s identity is established by additional documents, data or information”.

While authorities worldwide may be imposing strict risk assessment regulations on online casinos, making KYC mandatory, it is important to understand that different jurisdictions apply this process at different times. As noted above, EU casinos don’t have to trigger KYC checks until customers deposit over 2000 EUR. However, it’s vital to understand that users who are citizens of the US and UK must be subject to KYC checks upon opening accounts.

The conventional procedure for verifying a customer’s identity is to have them submit their personal information along with supporting official documentation. Online gambling platforms must send this documentation to official independent third-party verifiers who check the authenticity of the documentation and run the information against global databases. In doing this, third-party verifiers can confirm that customers are who they claim to be.

Equally, by running customers’ data against global watchlists, verifiers identify any Politically Exposed Person (PEP); people holding positions of political power who are therefore vulnerable to corruption. These checks also flag any financial sanctions that a user may have against them which might also pose a threat to the casino.

In line with recently enhanced regulation, third-party verifiers must also compare customer data to self-exclusion lists to prevent any gambling addicts from having access to casinos for the period of time they have voluntarily excluded themselves.

Lastly, these checks will also require users to identify their source of income, as to draw attention to any suspicious transactions.

What Do Casinos Need to Verify Identity?

There is no standardization for the documentation and information needed to identify and verify customers. That said, most regulatory bodies worldwide provide a list of the types of documentation that would be valid for verifying ID.

In general, basic identification and verification include a customer’s full legal name, address, and social security number (in the US). However, for full casino KYC checks, users need to submit official documentation for identity verification with third-parties. In some cases, such as for large transactions, users may be required to support proof of their source of income.

The types of documentation that are accepted for verification are split into two categories: Standard Proof of Identity and Standard Proof of Address.

Standard Proof of Identity documents may include:

- Passport;

- Valid Driver’s License

- EEA Member State Identity Card;

- National Identity Card;

- PAN Card;

- Voter’s Identity Card;

- Bank Pass Book (if it has a photograph);

- Employee identity card (only for listed or public sector companies);

- University ID card;

- Birth Certificate (although users normally need to submit a photo of themselves holding the certificate, along with another form of ID).

Standard Proof of Address documents may include:

- Utility Bill;

- Council Tax Bill;

- Bank Statement;

- HM Revenue and Customs Self-Assessment Statement;

- House or Car Insurance Certificate;

- House Deed;

- Lease Agreement with 3 months’ worth of rent receipts.

What Are the Problems of ID Verification for Casinos?

Manual identity verification and KYC procedures are slow, expensive, and clunky. With no standardization of required documentation, user experience can suffer as different establishments require varying details and users have to submit their data over and over. Not only does this pose a security risk as users offer up sensitive data to a plethora of different gambling organizations, but the slow onboarding also causes users to drop out of applications and move to less legit sites that don’t require verification. The higher demand for online gambling services means that more and more KYC checks are being submitted. This leads to a huge backlog of applications for verifications, with some KYC approvals taking more than a week to complete.

Perhaps a bigger problem is the increasing cost of compliance. Now that many online casinos are classed as non-bank financial institutions, there are stricter rules on compliance. This means that gambling entities must now hire costly fraud management teams and compliance officers to ensure that KYC and AML procedures are in place and being followed. Additionally, gambling entities must now employ a Money Laundering Reporting Officer (or team, depending on the size of the establishment) or face legal prosecution.

In this vein, reports show that over the past 5 years, 68% of online gambling companies have had to increase their AML and KYC budgets. On average, these companies are spending 74% more on regulatory compliance. With these figures in mind, 65% of online casinos have reported that they will be increasing their compliance budgets further over the next by an average of at least 13%.

Not only that, passing out sensitive data to a plethora of third-party verifiers leaves this information vulnerable to malicious actors. With so much data constantly changing hands, this information becomes vulnerable to identity theft. Not only that, as third-party verifiers are only human, they are often tricked by fake documents and fraudulent information.

On top of this, the cross-border nature of online gambling means that players hail from all different countries. While third-party verifiers may have the tools to validate US or UK players, sometimes operators simply don’t have the tools to validate smaller countries’ ID documents correctly. In these instances, high-risk users may slip through the net.

Equally, the lack of standardization between regulatory bodies makes it difficult for online casinos to be sure that they are staying compliant. On a basic level, for EU-based casinos, it can be difficult to know when to carry out KYC checks. Should identity verification be undertaken at the 2000 EUR mark as per EU legislation, or should KYC checks be carried out upon account opening, in line with stricter UK legislation? With such large fines at stake, this can be confusing for online gambling entities.

But what does all this mean for online casinos and identity verification? These figures show that manual KYC processing for online gambling establishments is problematic because it doesn’t scale. The more users that enroll on online gambling sites, the more costly and slow ID verification procedures will become. With this in mind, there needs to be a more effective and efficient solution for KYC and identity verification to ensure that online casinos can stay compliant with regulation now and into the future, without breaking the bank or causing undue friction in the onboarding process.

How Does GetID’s Automated ID Verification Improve KYC for Casinos?

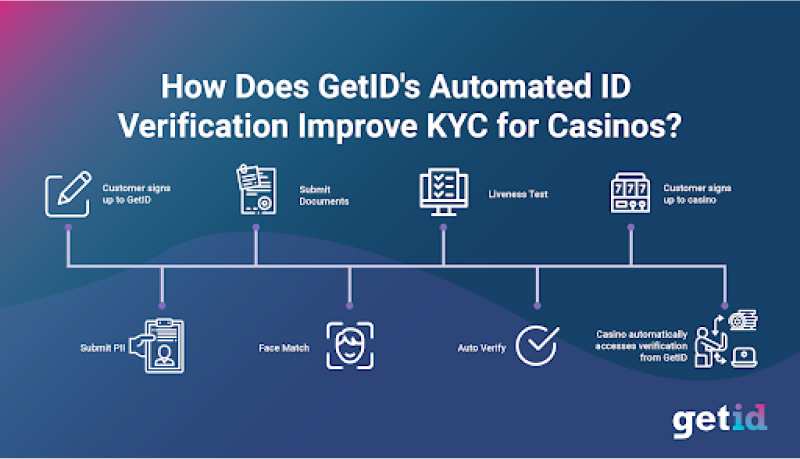

GetID is providing a next-generation KYC solution powered by cutting-edge technology. Aiming to reduce the bottlenecks in identity and age verification procedures, GetID offers a one-stop-shop for smoother KYC processing.

Introducing GetID’s multi-layered verification architecture, the platform uses state-of-the-art software to ensure accurate, speedy identity verification for a fraction of the cost.

GetID’s omnichannel platform offers a stratified tech stack combining Optical Character Recognition (OCR), Face Match, Liveness Detection, and automated PEP/Sanctions checks. This automated process speeds up verification, increases accuracy, and cuts out the costs of expensive intermediaries.

For customers, the process of ID verification is simple and fast and only needs to be completed once. Users submit PII information, which is automatically scanned by our OCR software, which extracts the relevant personal information for identification and verification. Next, our Face Match technology uses biometric scanners to verify a customer’s visual identity against their documentation. Liveness Detection ensures that the system cannot be tricked using face-spoofing methods. It does this by asking the user to complete a task live on camera. This prevents users from fraudulently submitting pre-recorded videos. Lastly, the GetID system checks all users against global watchlists to flag up PEPs and sanctions automatically.

Once this has been done, users now have a verified Digital ID. Rather than storing important PII data and official documents on sketchy centralized data silos, the GetID system only holds a copy of the verification certificate. This verification certifies that the user’s ID has been officially verified. For casinos and financial institutions, this verification certificate is available instantaneously.

This cuts out the unnecessarily long wait times incurred when submitting data to third-party verifiers. In fact, the system eradicates the need for these expensive intermediaries altogether, resulting in huge savings for online gambling establishments and massive reductions in inaccuracies. Equally, by automating the process, online casinos can stay up to date with all compliance regulations now and into the future, without the need for a large compliance team. To top it off, all sensitive data is stored on the user’s devices, getting rid of the need for expensive data storage solutions and mitigating the risk of a data breach.

In this sense, GetID provides a faster, cheaper, and far more secure solution to identity verification for online casinos, that’s 100% compliant.

Conclusion

Identity verification procedures are now mandatory for the majority of large online casinos and gambling platforms. Ensuring you know the identity of players on your gambling platform is integral to protecting your casino business from fraudulent users, problematic gamblers and money laundering.

Not only do identity and age verification procedures protect your gambling platform for malicious actors and financial crime, but they also ensure your online casino business is complying with increasing AML regulations. By employing strict KYC procedures, you prevent your company from falling victim to exorbitant non-compliance fines due to poor AML protocols and shoddy self-exclusion checks.

The problems, however, lie in the inefficiencies of manual KYC processes. With confusing cross-border regulations and a lack of standardization, manual KYC processes are often littered with inaccuracies. Not only that, but increased compliance means a higher frequency of KYC checks, leading to more friction in the onboarding process and far higher compliance costs — Not to mention the increased costs and stress of securing PII data.

Luckily, GetID is bringing a next-generation KYC solution to the table. Cutting out third-party intermediaries with our automated omnichannel digital ID platform, GetID offers your users a far smoother onboarding experience, leading to higher conversion rates as fewer users will drop out at the onboarding stage. Cutting out KYC costs and delays for online gambling platforms, our multi-tiered ID verification system ensures top levels of accuracy and security, with instantaneous access for a fraction of the cost. With tight security measures and greater accuracy, casinos can enjoy a high quality of well-intentioned customer, without worrying about fraud.

If you’re looking for a fully compliant KYC solution for slicker ID verification on your online casino, contact us to find out how GetID can help your business today.