Identity Verification in Sports betting – are all bets off?

21 Jul 2020

Introduction

As organised crime continues to proliferate and infiltrate sports betting, here we take a look at the regulatory challenges faced by the industry, and how GetID can help bookmakers reduce compliance risks by using state-of-the-art identity verification software in an ever-changing landscape.

Sports betting has grown into a multi-billion dollar industry but is facing greater scrutiny by regulatory and law intelligence agencies. Criminals seeking to launder proceeds of crime continue to exploit weaknesses in know your customer (KYC), identity, fraud, and anti-money laundering (AML) controls. Recent record fines and scandals have put all bets off! Regulators are moving up a gear up and have urged sports betting companies to perform effective due diligence and greater care in how they identify and interact with customers.

In a fiercely competitive landscape where a risky bet is just around the corner, bookmakers must ensure they have scalable and proven technology that helps identify, manage, and mitigate risks. Read below for insights into the sports betting industry and how GetID is a safe bet to achieve regulatory compliance.

Sports betting market overview

Sports betting is a gambling activity that predicts a result after placing a wager on the outcome. The popularity of sports events such as football, horse racing, cricket, baseball, American football, and others, has grown significantly over recent years. They attract massive consumer and media interest generating billions in revenue through sponsorship deals, broadcasting, merchandising and betting. Sports companies are increasing expenditure on marketing and promotional activities to attract viewers and spectators to build on its current growth trajectory. Sports betting companies rank among the top sponsors of sports teams.

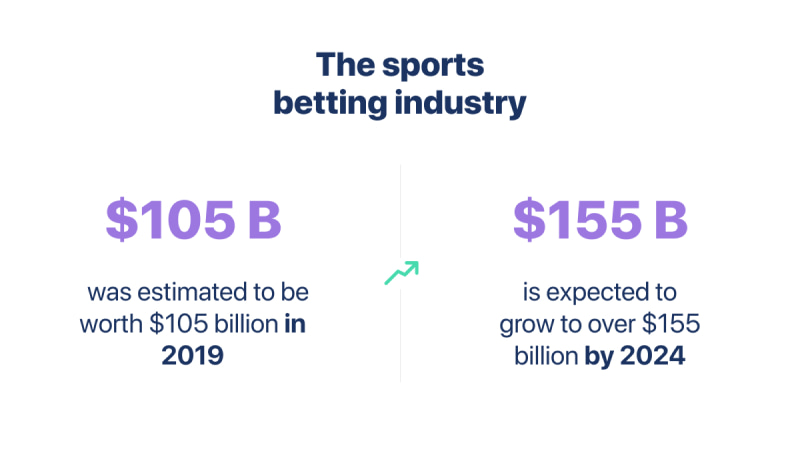

Unsurprisingly, growth in the sports industry is having a positive impact on the global sports betting market. In 2019, the sports betting industry was estimated to be worth $105 billion and is expected to grow to over $155 billion by 2024. Sports betting holds 70% of global gambling revenues – more than the lottery, casino’s, poker and other forms of betting. Out of all the regions, Asia Pacific holds the most significant share of the market followed by North America. Sports betting is well placed to grow dynamically due to increasing popularity and exponential demand of virtual and online betting.

The market is segmented based on sports type, platform, online and offline, respectively. The online segment is by far the largest and dominates the sector. This includes, in-play, fixed betting, daily fantasy, spread betting, exchange betting, e-sports and others. Recent technological developments including mobile apps have transformed the process of conducting sports bets. However, with this transformation and digitisation comes greater risks.

Forms of illegal activities in the industry

Organised crime in Sports betting

Sports betting has historically attracted organised gangs. Criminal enterprises often use gambling to wash dirty money clean. The risk of money laundering, fraud, embezzlement, corruption, and fraud is very high in an industry that attracts the mafia, drug cartels, and criminal gangs. This poses a real and serious risk to the industry. Staying one step ahead of criminals is not an easy feat.

Organised crime groups often use money made from sports betting to fund other criminal activities like human, drugs, and arms trafficking. The Gambino family dominated organised crime in the U.S., since the 1900’s. In 2013, the FBI arrested 20 gangsters for involvement in illegal internet sports bookmaking.

Frank Lawrenece Rosenthal aka Lefty, who inspired the Martin Scorses film ‘Casino’, had a keen eye for great odds and was soon working with the mafia running an illegal bookmaking office. Sports betting not only makes great Hollywood movies but is rapidly evolving and seeing increased risk of infiltration by organised crime and money launderers.

Money Laundering

The sports industry is particularly vulnerable to money laundering schemes and by far the biggest issue with sports betting is the ability to launder large amounts of money through its channels. Money launderers have long run illicit funds through sports betting and they won’t be stopping anytime soon! It’s estimated over $2 trillion dollars a year is laundered globally but only 1% of illegal funds or assets are frozen or seized by the authorities.

Fraud

Fraud is increasingly becoming more sophisticated and blurring the boundaries with money laundering. Sports betting fraud involves the fixing of results or odds to deceive bookmakers. Fraud can take shape in different forms. Rob Gorodetsky, a high-stakes sports gambler, faces up to twenty years in prison due to defrauding an investor of almost $10 million, committing wire fraud, and tax evasion or avoidance.

Betting syndicates

In this scam, organised criminals will try and convince you to become a member of a betting syndicate. Often, you will need to pay a compulsory joining fee, open a sports betting account, and make ongoing deposits to maintain the balance of the account. The scammer tells you the funds in the account will be used to place bets on behalf of the syndicate and promise a percentage of the profits. Fraud comes in many forms.

Illegal betting

Illegal betting is a huge problem for the authorities and estimated to be worth over $500 billion per annum. Run by nefarious gangs, they operate without a license and are involved in match fixing, doping, and other illegal activities. Criminals don’t answer to the authorities until they are caught! Illegal betting operations are difficult to stop and they are popping up around the world.

Cyber-crimes

Sports betting is vulnerable to another crime that is juxtaposed with fraud – cyber-crime. Phishing, hacking, ransomware, and account takeover – cyber criminals are using more sophisticated methods to infiltrate networks, servers, and end-users. Cyber attacks can range from manipulating betting lines by social media hacks, to direct attacks on the company’s network and infrastructure. This can result in huge gains for criminals but big losses for bookmakers.

Sports betting companies are faced with greater risks than ever before. The financial crime and threat landscape is evolving and changing at an unprecedented pace. Criminal typologies are merging, and organised gangs are using a more holistic approach to committing crime. Bookmakers face unprecedented challenges.

Regulatory and enforcement action

Regulatory and law enforcement bodies recently stepped up action. Earlier this year, the online betting firm Betway paid a £11.6 million settlement with the UK Gambling commission. Betway was reprimanded for accepting stolen funds from high-spending customers. The investigation showed £5.8 million flowed through Betway who failed to verify the source of funds and fulfil it’s money laundering obligations. Problem gambling was allowed to continue and twenty high risk accounts were not shut down. Regulators are getting tougher with punitive action.

The UK Gambling commission continued regulatory action against other firms, and in April 2020 dished out a record £13 million fine to Caesars due to systemic failures in AML and issues enforcing responsible gambling.

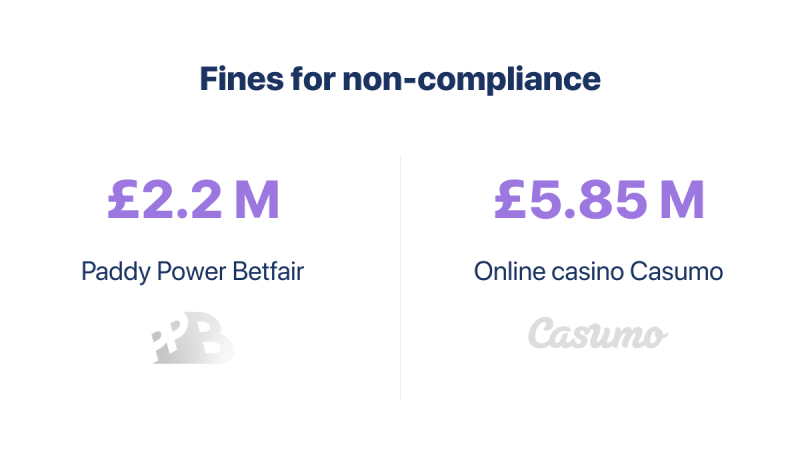

There have been other fines too: William Hill was fined more than £6 million for breaching AML regulations, and 888 Holdings Plc £7.8 million, respectively, for failing to protect customers.

Regulators are cracking down on crime and taking a no-nonsense approach. In the first quarter of 2020, over €28.3m in fines, penalties and settlements were issued globally surpassing the £16m levied in 2019 in its entirety. The sports betting industry is under the spot-light and you can bet there are more fines in the making.

Breaching AML regulations can not only land you in hot water with the regulator, affect your reputation, and lead to financial losses, but the authorities have the power to suspend or revoke betting licenses. Non-compliance can have devastating and serious consequences both for businesses and individuals. Personal liability and accountability holds senior managers personally responsible for misconduct and market abuse. Three members of the senior management team at Caesars were forced to surrender licenses meaning they can no longer work in gambling. In an industry attracting vast numbers of smart criminals, the stakes for non-compliance are high.

Legislations and Regulations

So we’ve seen bookmakers are becoming increasingly exposed to the risk of financial crime. In response, the Financial Action Task Force (FATF) – an intergovernmental group setup in 1989 – set out a comprehensive framework of measures termed ‘The FATF 2012 Recommendations’, which countries should implement to combat fraud, money laundering, and other predicate offences.

A key requirement of the FATF 2012 Recommendations is for businesses to be fully aware of the risks and assess the suitability of customers they deal with. KYC has emerged as a norm and a fundamental part of the compliance process along with customer due diligence (CDD). This means a business must verify the identity of its customers and conduct ongoing screening of business transactions and entities.

PEPs and Sanctions

The two important elements of screening when onboarding a customer for the first time is screening against Politically Exposed Person (PEPs) and sanctions lists. Financial or business relationships with individuals or entities on PEPs and Sanctions lists are very high risk.

A PEP is defined as a person who currently or has in the past held a public or prominent position which may be abused for financial gain. PEPs may pose a heightened risk of bribery, corruption, money laundering, fraud, and terrorist financing. Such public figures may use family members, relatives and close associates to launder proceeds of crime or disguise the money trail. PEPs can be international, local, national, or domestic, and include figures/heads of government, high ranking officials, individuals performing judicial roles or board members of state owned entities and sports committees. Performing PEPs screening on your customers is a mandatory part of KYC, identity verification, and CDD along with sanctions checks.

Sanctions screening is important to protect businesses from being used as vehicles for money laundering and other financial crimes. Sanctions are economic, financial and trade restrictions against designated targets, individuals and groups. Sanctions checks are part of the required AML legislation both domestically and internationally to ensure businesses do not deal with individuals who are restricted from certain activities. By law, it is illegal to engage in business with a sanctioned individual or entity.

There are various sanctions regimes globally. The United Nations Security Council resolution has established thirty sanctions regimes since it’s inception ranging from comprehensive economic and trade sanctions to targeted measures such as arms embargoes, commodity restrictions, travel bans and financial restrictions.

The U.S. Department of Treasury’s Office of Foreign Assets Control (OFAC) maintains several sanctions lists including a specially designated nationals (SDN) list, and comprehensive sanctions against named countries such as Syria, Iran, and North Korea, respectively.

In the European Union, the sanctions list supports specific EU foreign and security policies and is based on the UN security council resolutions. Both the EU and OFAC sanctions have it’s own version of a 50% rule to establish the ownership and control of an entity to ascertain whether it is subject to sanctions restrictions even if not sanctioned by name.

Breaching sanctions increases the risk of getting on the wrong side of the law. Sports betting companies must be very careful not to deal with sanctioned countries, individuals and entities, and ensure they perform screening at the onboarding stage and part of the ongoing monitoring process. PEPs and Sanctions is a core part of KYC identity verification and understanding your risk exposure. Failure to do so may lead to fines, reputation damage, law enforcement action, a collapse in your financials, having your betting licence revoked, or even jail time! Failing to screen for sanctions may not be worth the gamble.

Money Laundering directives

In 2015, the 4th EU money laundering directive was approved and came into effect in June 2017 bringing greater scrutiny of AML by regulators. The entire gambling sector now falls in scope and subject to stricter AML laws & regulations. The 4th EU money laundering directive is preceded by the 5th which came into force in January 2020. The impact of the 5th EU MLD is far reaching and extends PEPs lists, beneficial ownership registries, high-risk jurisdictions, high value goods, prepaid cards and cryptocurrencies, respectively.

A big focus of the money laundering directive is the emphasis on adopting a risk-based approach, identifying and verifying beneficial owners, and performing adequate risk assessments i.e. CDD and enhanced due diligence (EDD). Countries which are part of the EU and EEA have transposed money laundering directives into local law.

Regulations by country

United Kingdom

In the UK, the Gambling commission is the competent authority for AML & KYC in the sports betting and gambling industry. The Gambling Act divides gambling into gaming, betting, and lottery. All gambling operators must obtain a local license. The applicable regulations in the UK for sport betting includes the Licence condition and codes of practice (LCCP), The Gambling Act 2005, Proceeds of Crime Act 2002, the Terrorism Act 2000 and the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2019. The latter gives effect to the 4th and 5th EU Money laundering directives.

Malta

The Malta Gaming Authority oversees betting, gambling and gaming activity in Malta operating as the regulatory body and enforcing the Gaming Act which came into effect in 2018. Malta is one of the most established betting and gambling jurisdictions and accounts for 13.2 % of overall economic activity in Malta.

Gibraltar

Gibraltar is a reputable sports betting jurisdiction with strict compliance requirements and a well-developed infrastructure for betting. The Gibraltar regulatory authority enforces the The Gambling Act, grants licences, and has the power to enforce actions such as penalties and fines.

United States

In the U.S. the financial crimes enforcement network (FinCEN) – part of the U.S. Department of Treasury – supervises financial crimes such as fraud and money laundering across all sectors including sports betting. Moreover, there are state-specific laws and each state has its own regulator where betting and gambling is legal i.e. Las Vegas Nevada. The legislative and regulatory framework in the U.S. can be more difficult for businesses to navigate.

There are various regulations and legislations that sports betting companies must comply with depending on operations, jurisdictions, customers, and transactions. Let’s have a look at how this affects a sports betting companies’ onboarding and identity verification process.

KYC and ID Verification

With stricter AML compliance regulations, high stakes for non-compliance, sports betting operators are legally obligated to comply with KYC and AML legislations in order to protect users and the business from criminal activity.

Bookmakers must develop and implement a sports betting KYC compliance program that defines how they identify, manage, mitigate, and report financial crime risks. The program must include a KYC & AML policy, procedures, processes and controls for both identification and preventative measures. Bookmakers must:

- Protect the company and users from bad actors and financial crimes;

- Comply with the relevant regulations both domestically and internationally;

- Ensure online sports betting identity verification delivers a user-friendly customer service.

The first and one of the most important steps in AML KYC compliance is identity verification. A bookmaker obtains the customer’s information to verify their identity, age, location and source of funds among others to ascertain whether they are involved in any financial crimes. A verification and authentication should take place to ensure the information provided is associated with a real person and who he or she claims to be. Documents such as a passport, driving license, or national identity card must be verified to ensure authentication and fraud detection.

One of the heightened risks in onboarding is cyber criminals using techniques like spoofing or deepfakes for online fraud detection and account takeovers. This is where liveness detection technology plays a crucial role to defend against these state-of-the-art attacks and protect your business against bad actors.

Sports betting identity verification processes can be complex, time consuming, and lack an integrated approach. The user may need to fill out an application form, submit documents, take a selfie, and then wait days for approval only to receive a request to repeat one or more steps. This clunky process can result in a poor customer experience, and the chances are the customer will give up and go elsewhere. Moreover, online sports betting document verification may involve the use of multiple vendors to verify an identity document. This may create a time lag between checks and leads to online abandonment and loss of customers.

PEPs and Sanctions checks need to be performed and bookmakers may use different vendors or systems generating high false positive rates. This may result in onboarding delays, and become a compliance burden for in-house teams. Moreover, false negatives generated by KYC software due to a lack of name matching algorithms or a failure of other compliance controls may result in unknowingly doing business with a prohibited person which can land you in hot water with the authorities.

Balancing compliance risk, profitability, and the user experience is paramount. Bookmakers don’t want to lose customers to competitors due to cumbersome and time consuming onboarding processes. In online sports betting KYC, efficiency and speed of onboarding is fundamental but at the same time bookmakers must not compromise the quality of compliance checks. Striking the balance between time, quantity, and quality of checks can be difficult with multiple vendors. Therefore, using an all-in-one kyc service provider for online sports betting document verification, liveness detection, and screening can lead to compliance gains and help drive efficiencies.

How GetID can help to reduce illegal activities and build trust

GetID is best positioned to help bookmakers with KYC onboarding, and identity verification using advanced biometric face recognition technology. Our industry leading omni-channel solution automates your onboarding process, reduces manual intervention, and frees up time for compliance teams to focus on the areas of highest risk.

Bookmakers can seamlessly onboard low risk customers but identify high risk subjects that warrant enhanced due diligence. This allows you to optimise resources, reduce risk, and drive down compliance costs.

Our next generation technology uses a multi-layered approach for best-in-breed security and accuracy giving you the highest levels of confidence and assurance. We use optical character recognition, biometric liveness detection, and facial recognition to safeguard against spoofing, deep fakes and other types of fraud. Our advanced facial recognition technology including OCR and liveness check automatically identifies and verifies users by matching their image to their official documentation and existing databases to perform a face match.

Using a single provider such as GetID for document verification, PEPs and Sanctions screening means there are less false positives and a greater level of precision and protection against financial crimes. Our screening engine will highlight any fraudsters, and matches on PEPS and Sanction lists, therefore allowing you to mitigate risks effectively. Our solution helps you comply with various domestic and international AML regulations, satisfy the regulator, and protect your brand reputation.

GetID is perfectly positioned to help sports betting businesses with a customer-centric, frictionless, identity verification solution that onboards customers quickly and allows you to balance risk versus profitability. An all-in-one solution for KYC Identity verification, GetID is easily integrated into any workflow with minimum setup costs and is used extensively by sports betting firms to:

- Achieve regulatory compliance;

- Fraud prevention, anti-money laundering and other crimes;

- Face matching and document verification online;

- Use advanced biometrics and liveness detection;

- Perform KYC/AML checks such as PEPs and Sanctions;

- Automate manual processes;

- Save time, reduce costs and risks.

GetID provides a seamless onboarding experience for your customers, and a quicker time to revenue keeping your customers happy and at the same time growing your book of business. In an industry faced with growing threats, choosing a flexible ID verification provider suitable for your needs is more important than ever before.

Reach out to GetID team to find out how easy it can be to onboard and verify your customers and keep the criminals at bay. It may be your safest bet today.