5 Benefits of Identity Verification (and How to Make it Happen)

1 Sep 2021

The number of global data breaches has skyrocketed in the past few years (in 2020 alone, data breaches exposed more than 5 billion records). This has led to an uptick in identity theft and account takeovers, and businesses now need a reliable way to confirm that someone is who they say they are.

The ability to do this quickly and without any road bumps is a vital part of business success. On top of this, companies need to build strong and robust fraud-prevention systems to comply with stricter AML (anti-money laundering measures), including KYC compliance.

Identity verification ventures beyond traditional and physical methods of authentication to help establish identities in the digital era. If you don’t already have a streamlined identity verification process in place, here are some statistics that demonstrate why you need one:

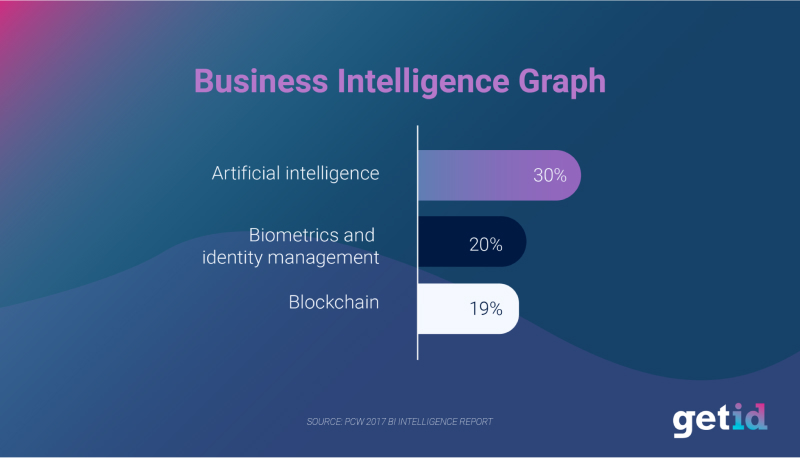

As we can see from the graph above, more companies are putting an emphasis on emerging technologies, including biometrics and identity management.

Integrating this kind of forward-thinking technology is becoming increasingly common for companies that need to run identity verification checks. This includes activities like face-matching using selfies, data extraction from documents, liveness detection, auto-checking watchlists, and automatic scanning for fraudulent documents.

Monzo asks its customers to record a short video of themselves talking to the camera to verify their identity.

It’s worth noting here that protecting and avoiding fraudulent activity is only one of the major motivating factors in identity verification. There are several other aspects that are worth taking into account, including compliance with key regulatory bodies and the ability for new customers to fully access digital services.

If you’re not already running water-tight identity verification for new customers, now’s the time to start doing so, not just because the slew of new tools and technologies has made it a pretty straightforward process.

1. Maintain or Improve Your Reputation

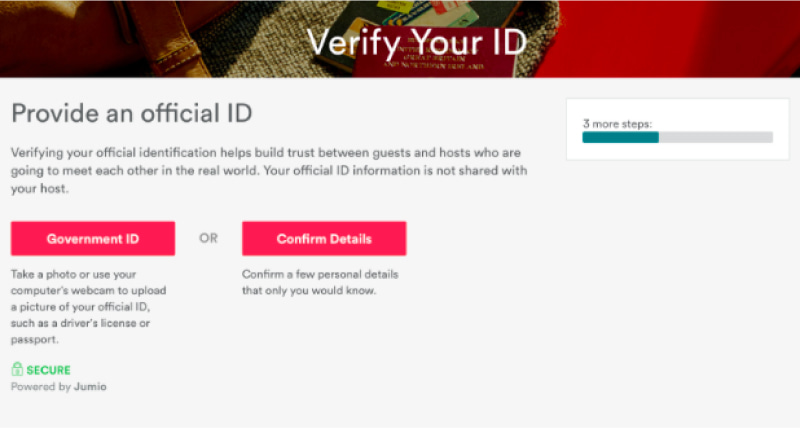

There’s a reason why Airbnb has shot to stardom: it makes everyone accountable. Both travellers and hosts have to verify their identity and maintain decent reviews, and this has created an in-built sense of trust from all sides.

Reputation is incredibly important for businesses of all sizes. In an age where there is so much consumer choice, it’s easy for people to hop from one brand to another if they don’t get exactly what they want.

On top of this, trust is more important than ever before as consumers actively seek out businesses they can rely on. In an era of continual data breaches, consumers want to know that their information is safe. By running identity verification checks, this signals that you’re serious about building trust in what’s becoming an unsafe online world.

Trust is the foundation of any relationship, particularly in a digital landscape that’s inherently fickle. Consumers can – and do – hop from one business to the next if they’re not getting their needs met or aren’t satisfied with the service being provided.

Failing to identify this need for trust between consumers and brands can damage a business’ reputation and their revenue. On the flipside, boosting your reputation and providing customers with the reassurance they need to use or continue to use your service can do wonders for your bottom line.

Being able to verify a customer’s identity quickly helps to cement that all-important trust.

This is why plenty of companies are turning to verifiers that take care of the identity verification process through customer documents, face-matching selfies, and checking the KYC watchlists. Implementing a third-party verifier speeds up the process as it keeps customer checks on file and allows companies to continue to onboard their customers without having to spend precious time fact-checking documents themselves.

Neil Bayton, the head of UK partnerships at Trustpilot, says:

“When a customer has that emotional connection with a business, they become an advocate. They not only tell others about the brand, but they want your business to succeed. People know how hard business can be at the moment and they want the genuinely consumer centric ones to thrive.”

Soothing the growing worries of consumers by incorporating a smooth identity verification process shows you value their concerns and want them to feel safe. The seeds of trust will then begin to sprout and grow. Implementing KYC means you care about customer safety on your platform.

2. Avoid Costly Fines

In 2020, fines for non-compliance with Anti-Money Laundering (AML), Know your Customer (KYC), data privacy, and MiFID regulations against the financial sector totaled $10.6 billion. Financial penalties for AML-related compliance breaches represent 99% of the total value of enforcement actions issued in 2020. One of Australia’s largest banks, Westpac agreed to pay a record AUD 1.3 billion ($959m) fine for money laundering breaches. Most businesses simply can’t afford a huge fine of this size, which is why AML and KYC systems are so important.

AML refers to a collection of regulations, laws, and procedures that have been specifically constructed to stop the practice of declaring illegally obtained funds as legitimate income.

This goes hand-in-hand with the need for KYC, which is essentially the process businesses go through to identify their customers and assess the risk of illegal activities.

Adhering to both of these protocols is important if you want to avoid costly fines – or, in some worst case scenarios, imprisonment.

Implementing streamlined, efficient identity verification software and practices aligns with AML and KYC requirements, which means businesses that use them sidestep any potential fines.

There are plenty of other individual rules and regulations that apply to businesses too depending on where they’re based and the customers they serve.

Today, there are more than 90 countries that now require businesses to verify the identities of their customers and keep identity records for a certain number of years.

This is part of a movement to prevent terrorism, money laundering, and other criminal activity that centers around stealing and assuming different identities. Remember that these regulations are constantly being updated and improved, so it’s worth staying on top of them to make sure you’re not falling foul of any rules.

3. Avoid Costly Chargebacks

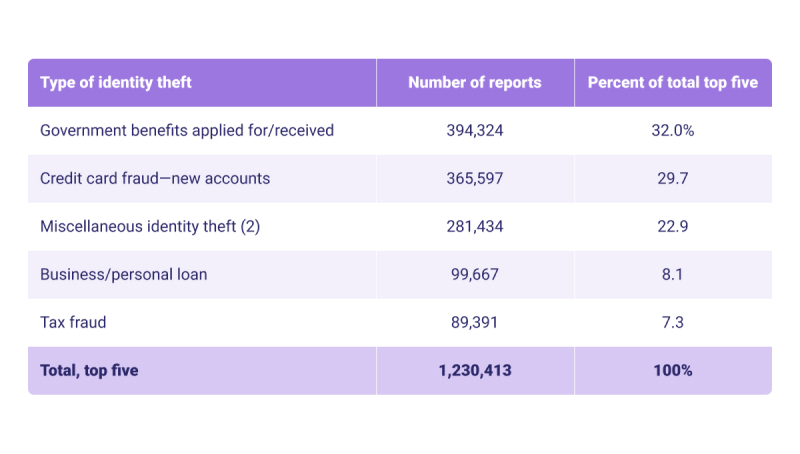

Credit card fraud makes up a huge portion of the total number of identity fraud cases every year.

When businesses began allowing their customers to use credit cards for online purchases, it became far easier to commit fraud since most transactions fell into the “card-not-present” category.

As a result, people would fraudulently use credit cards that weren’t theirs to buy goods online and, once the real owner of the card found out, would cancel the transaction. Without being able to identify and trace the original fraudster, the business would be liable to pay back the money.

This is known in the finance world as a chargeback.

Unfortunately, they can be a costly part of business for companies that accept credit card payments (with fees, operating expenses, and customer acquisition costs, companies often lose 2 to 3 times the amount of a refundable transaction.)

Identity verification stops this in its tracks by fully verifying each and every customer.

For many businesses, preventing costly chargebacks is simply a case of revising identity verification protocols for card-not-present transactions so that they incorporate one or more identification methods (say, for example, facial recognition or a two-step verification process).

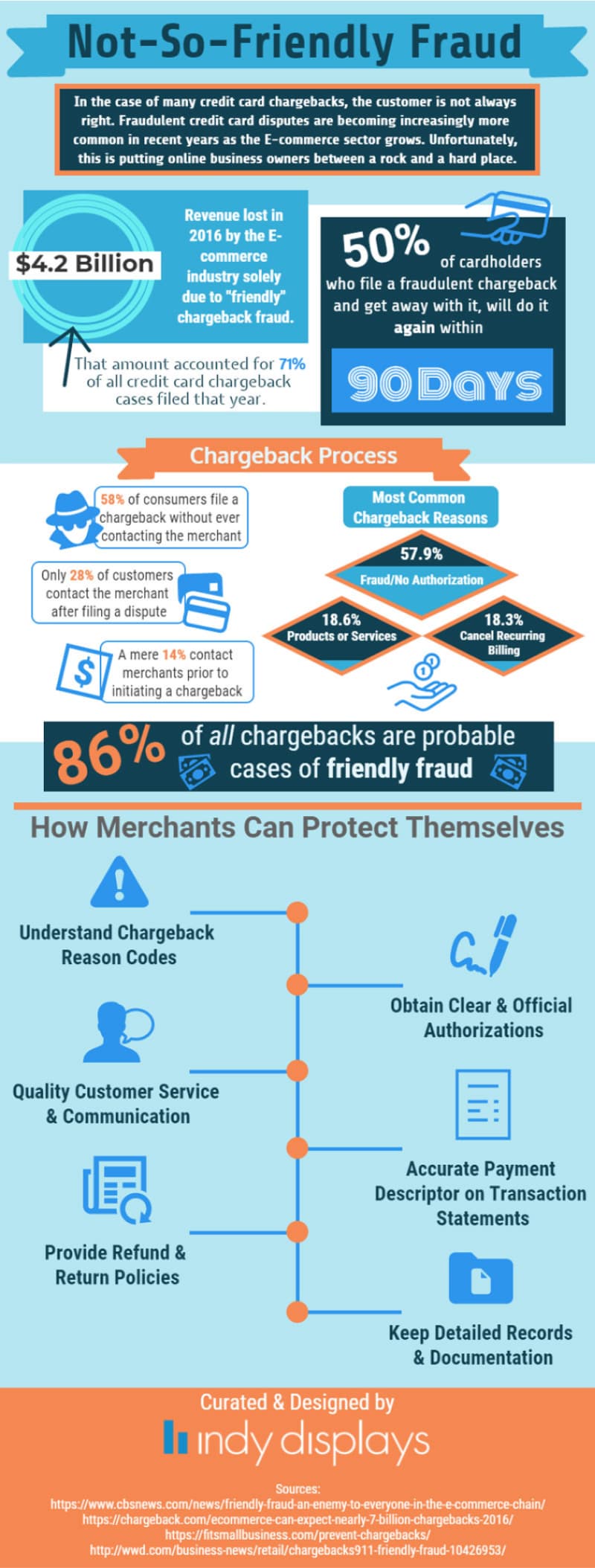

Tighter verification methods can also stop cases of “friendly fraud” in its tracks, too.

This is when well-intentioned customers file for a chargeback rather than a traditional return from a company they’ve made a purchase from. They simply assume that it’s just a different way to get their money back without realizing the effects it might have on the business.

For other, less well-intentioned consumers, chargebacks mean they can get something for free. They continue to file for chargebacks claiming they never received an item when they did. Identity verification can squash the number of friendly fraud cases as it means “cyber shoplifters” can no longer act anonymously.

4. Avoid Fraud and Money Laundering Concerns

Earlier, we wrote about Standard Chartered getting fined a hefty amount for money-laundering this year. Being fined such a huge amount is a serious concern for most companies – particularly those with a modest income.

Even an accusation of money laundering – however small – can spell the end of the road for a business, regardless of its size. As a result, organizations are leaning more and more towards using risk-based models that incorporate identity verification to assess which users might be high risk.

They can then use this data to create authentication levels based on the risk potential of certain transactions (and then mark those that are good and those that might be fraudulent accordingly).

This is becoming increasingly important as the business landscape gets more and more digitized. Making sure customers are who they claim to be is a major component in creating digital trust.

To avoid fraud and money laundering activity, many businesses are turning to two-factor authentication, where consumers are required to provide two forms of identity, like a passport, a bank card, or their face for facial recognition.

The most basic example of two-factor authentication can be seen in action at ATMs. Consumers must have their PIN and their bank card to withdraw money – two factors that prove they are who they say they are.

As more and more transactions happen online, companies are having to rethink their identity verification processes to make them more internet-friendly.

5. Improve Customer Experience

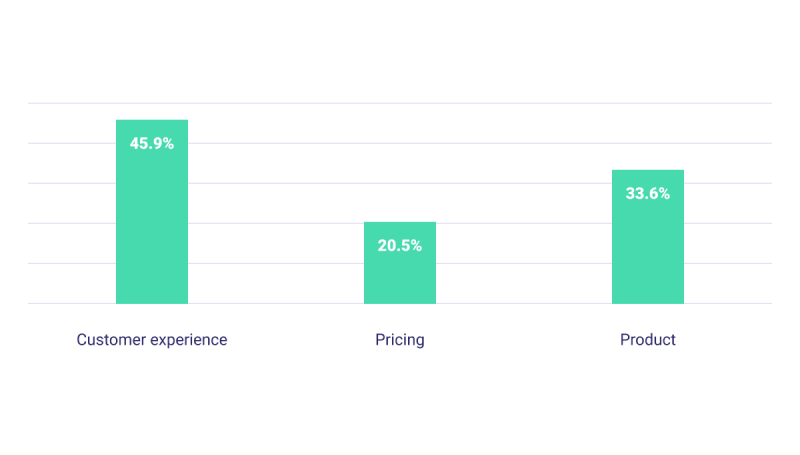

As seen in the graph above, customer experience has been named the most exciting business opportunity for the coming years.

Today, consumers want a customer-centric experience with every business they buy from, and a great user experience strives to reduce any barriers that consumers might have while simplifying processes.

The term “frictionless” is often thrown around in relation to good identity verification processes – this means not asking the customer for too much information and instead obtaining information about them in other places.

This means you can create a well-oiled, digital workflow that eliminates most – if not all – need for manual entry and paperwork which can often take a number of days to process. As a result, customers get a smoother onboarding experience and, more importantly, can get instant access to your product or service.

Integrating biometric solutions and digital identity verification methods like facial recognition, automatic scanning, and liveness detection means customers don’t have to wait hours or even days to get started.

For most businesses, the identity verification process looks a bit like this:

- Step 1: gather ID documents, like passports, ID cards, or driving licenses

- Step 2: verify the authenticity of the ID documents

- Step 3: carry out customer authentication to make sure the person presenting the ID is the same person the ID relates to

- Step 4: create a report for auditing purposes

While this method is perfectly fine, it can take a while to process the documents, particularly if it’s all being done manually.

Moving to a digitized process is far more convenient as identity checks can be carried out in the background almost immediately, meaning consumers don’t have to wait at all.

Having a well-oiled, almost-instant process like this in place can drastically increase conversion rates. A good customer experience keeps people coming back for more. In the context of identity verification, it means making processes simpler which, therefore, means more people are likely to complete them.

What’s Next For Identity Verification?

The technologies that fuel identity verification are being tweaked and enhanced every single day. In the not-too-distant future, there are murmurings of a blockchain-enabled decentralized identity for everyone on the internet.

The motivation behind this is that it will give people more control over their personal information and businesses can take a backseat from managing identity documents and what has been a very hands-on verification process.

Conclusion

In summary, data breaches have scared consumers. To alleviate these fears and avoid costly fines and money laundering concerns, it’s important for businesses to implement a smooth identity verification process that’s customer-friendly and adheres to organizational guidelines.

GetID is the perfect solution to these problems, as it offers clients a simple, secure, safe, and quick identity verification process that’s easy to use, and which only requires users to submit their data once during the entire process.

Furthermore, GetID also takes care of KYC/AML procedures, offering users the ability to track all of the checks carried out by third-party providers in one place – the Admin Panel.

Get in touch to find out how GetID can revolutionise your identity verification process.