Proof of Address – A Powerful Service by GetID

4 Sep 2022

Address of residence is an important identification attribute for customer verification. Together with other data, having a verified address complements the due diligence and identification requirements of KYC (Know Your Customer) and AML (Anti-Money Laundering). Most often, Proof of Address is requested by financial companies when providing certain services.

When to use it

- There are geographical restrictions. Where services are only available to customers from certain regions.

- To comply with financial regulators’ requirements for certain transactions

- To comply with in-house risk department requirements for clients from high-risk regions

- To prevent and reduce fraud

Address verification can also be used by e-commerce companies to reduce delivery errors.

Proof of address – how does the process look like

Everyone lives somewhere, but not everyone can be visited by us to make sure they have the right address. Moreover, company representatives aren’t able to go to your home. But every customer has proof – the documents confirming a real physical address. The verification process involves processing this document to compare it with the data the client has previously provided.

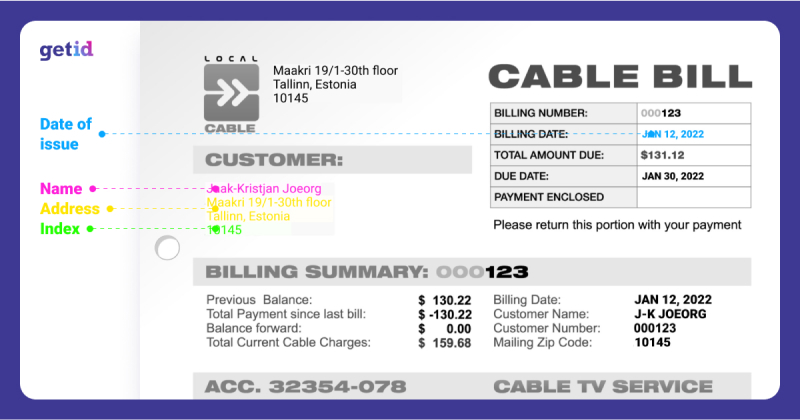

This document must contain the client’s name, address, date of issue or expiry date of the document. In addition, the name of the organisation issuing the document must be clearly visible.

Types of documents acceptable for proof of address:

- Utility bill

- Bank statement

- Government letter

- Life insurance

- Post office letter

The most frequent use of the address verification procedure is by financial companies. This is due to the requirements of financial regulators in different countries. Address verification is part of KYC policy.

Also, organizations operating in countries with a high risk of fraud develop their own customer verification procedures. They include a requirement to verify a person’s residence information.

The main problems in Address Verification

This procedure is considered to be more complex than a basic document check. Here are just a few of the challenges companies have when it is necessary to include this verification.

No common standards

Look at the list of documents that can be considered as proof of a client’s residence. There are thousands of variations in the appearance of these documents with no obvious similarity or uniformity in how the information is organised. Every country and every company has adopted different templates, whether it is a mobile phone bill or a utility bill.

However, we know exactly what data we need: name, address and date. Now the operators look at and find this information in a variety of documents. From here, the following problems arise.

Delay in the process and growing error rate

The customer has to find and scan documents or send a paper copy by post. Dozens of different papers reach your operator. How many documents a day can he/she process manually and enter in your database without any special software? The reality shows that such a process is time-consuming and makes customers wait for hours, days or even weeks.

Manual work invariably increases the number of errors made in filling in the data.

Rising processing costs

The manual verification process makes it difficult and often impossible to scale with a growing number of clients. The capacity of each operator is physically limited. As the number of employees grows, so do the costs of the whole process. This problem is particularly acute when you have clients from different countries connecting to your service.

New methods of address verification

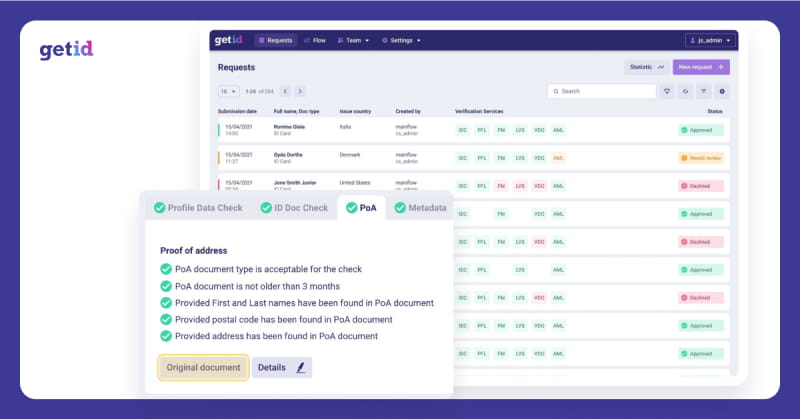

Technology makes it possible to automate and simplify much of the address verification process. Services use a combination of artificial intelligence and human professional expertise.

Online address confirmation can reduce the procedure to a few minutes.

How does it work?

Let’s take the Proof of Address by GetID as an example. The whole process is similar to document verification.

Proof of Address can be an important tool for the comprehensive identification of your customers. GetID’s solution is a highly advanced automated process. You can use address verification only for a specific customer segment, and configure the results to be sent to your system.

Get a free consultation with GetID team for user verification and service integration.