All-in-one AML KYC Compliance Solution

Stay compliant with regulations, manage and mitigate compliance risks and streamline the customer onboarding process. A comprehensive and flexible solution that can be tailored to your needs.

Stay compliant with regulations, manage and mitigate compliance risks and streamline the customer onboarding process. A comprehensive and flexible solution that can be tailored to your needs.

Flexible and secure software that can be easily integrated into your workflow.

Verify user identities and documents in a matter of moments for quick customer account opening and risk mitigation. Save time and reduce operational costs.

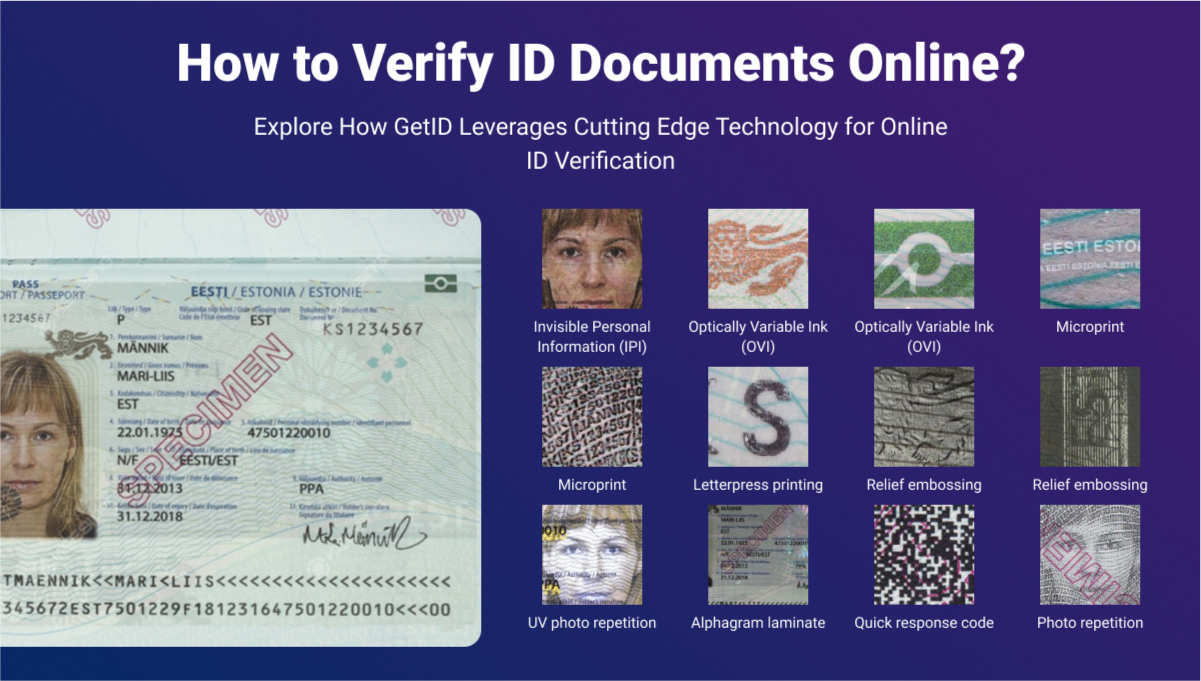

Verify and authenticate ID documents at scale in real time.

Save time and money by automating the KYC/Identity Verification process.

Add another level of security to prevent fraud. Liveness Detection ensures that the users are “live” by asking them to complete a task on camera (smiling, blinking or turning their head).

Verify a customer’s identity by comparing an ID document photo with a selfie-picture to make sure that they (both) belong to the same person.

A comprehensive service that helps you manage the risks, carry out Customer Due Diligence and follow the best security standards.

Global Coverage

900+ types of document types and 190+countries supported.

Compliance with regulatory requirements

Stay compliant with global regulatory requirements (FATF, FINMA, FCA, CySEC, MAS, FSA)

AML Screening

High-risk clients monitoring for customer due diligence.

Process automation

Automate the process and reduce your compliance team workload.

Protect your business and reputation using a risk-based approach. Check your customers' data globally against 11+ million screened profiles.

Sanctions Lists

Identify people associated with criminal activity, national and global sanctions. Over 800 global lists (OFAC, HMT, FINRA, Interpol).

PEPs (Politically Exposed Persons)

Continuously updated data on PEPs and their close associates. 1.6 million complete and detailed PEP profiles.

Adverse Media

Get more information about your clients for better risk assessment and management. Billions of screened media articles with constantly updated data.

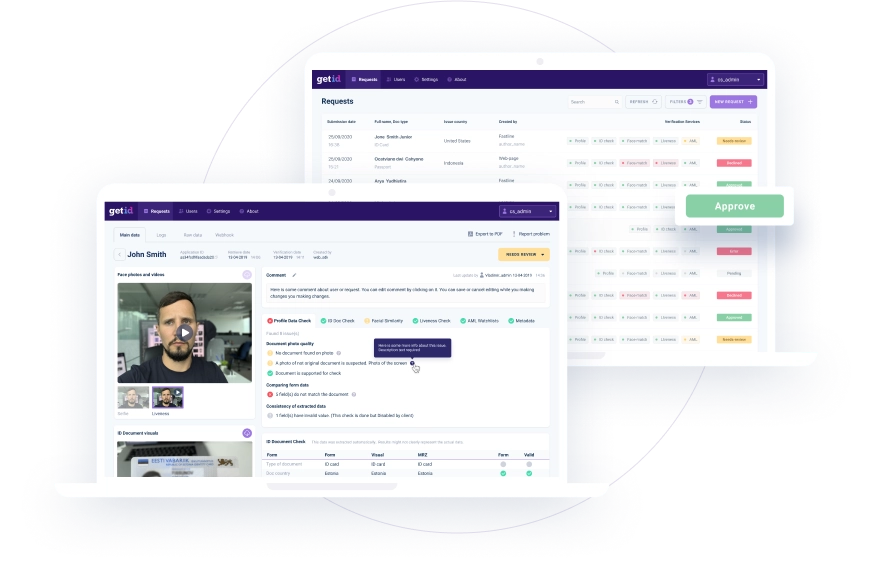

Cloud-based software with full access to verification results. Easily navigate and control your KYC and onboarding process at one place.

A range of set-up and integration options to fit your UI/UX:

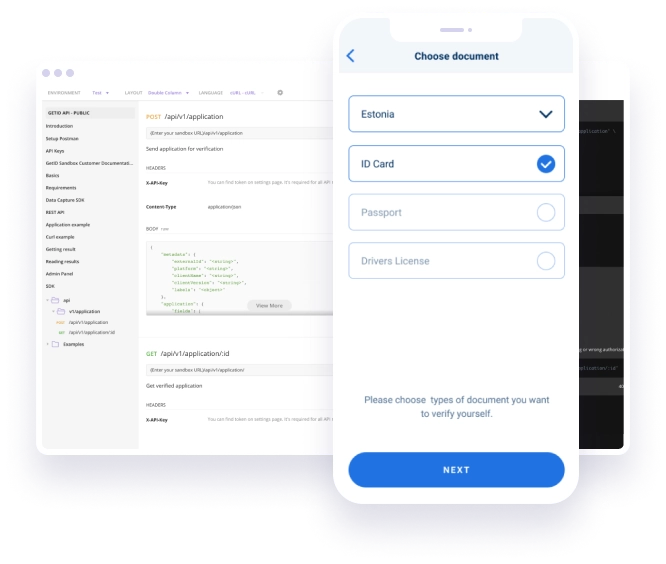

Mobile SDKs

Highly-customisable iOS and Android SDKs built on native tech stack for a seamless onboarding experience.

Web SDK

Ready-made solutions for automated onboarding with fast set-up and easy configuration.

Cloud-based verification page

Send a link to customers and get verification results instantly in your Admin Panel or via webhook.

API integration

Integrate our KYC and customer verification solutions into your platform, collect data you need and get the results via API.

Read our related articles prepared by proven experts in the field

ID verification software is a combination of all the knowledge, experience and KYC verification acquired in the industry within the past 20 years. All that combined…

KYC and AML regulation are increasing to cope with the rising demand for financial services and the pressing need for increased security and protection…

Identity theft is a growing concern for governments, consumers, and businesses. The Research and Strategy institute, Javelin Strategy, discovered that identity…